It seems like fraud is everywhere today. You can’t go more than a month without hearing about security breaches or someone trying to steal data or scam people. The IRS is not immune from such fraudulent activities, so in the past few years we have seen them do their best to shore up efforts to prevent such activities. Consequently, most changes for W-2 and 1099’s this year is trying to limit such activities. Let’s walk through the changes.

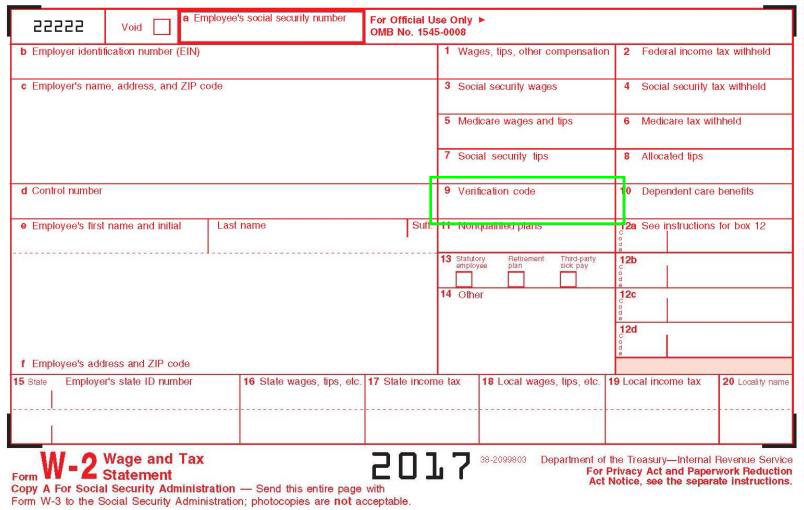

When you produce (or receive) W-2’s this year, you may notice that Box 9 has been opened up. The IRS has created an optional code to help verify W-2 data with employees’ 1040 electronic filings. This is not required for 2017 filings, so if the box is blank (or if you see data) there is no cause for concern.

Last year filing deadlines changed, even though there is no change for 2017, it is a change that bears repeating. If you are filing a 1099-MISC with information in Box 7 (Nonemployee Compensation) or any W-2, these files must be electronically filed or postmarked to the IRS by January 31st (same deadline as distribution of employee and 1099 recipient copies). The IRS changed this last year to combat fraud – the sooner they get the information to confirm, the fewer people will be able to file fraudulent 1040’s. In the past, criminals would get huge tax refunds paid out before W-2’s were due, and the IRS had no way of confirming that the W-2 used to produce that fraudulent refund wasn’t legitimate, since the form wasn’t due to them yet! With the new deadline they are hoping to be able to look at the W-2 or 1099 filed and confirm the information prior to issuing the refund.

This year, several states followed the IRS’ lead and said “If you can require it by January 31st, we can too!” For 2017, if you have to file W-2’s or 1099’s to the following states, you must have it submitted by January 31st: Arkansas, Arizona, Kansas, Maine, Minnesota, Missouri, Montana and Nebraska. Other states already had the January 31st deadline, some still have later deadlines, but the ones above changed this year.

There are some other changes in state filing not related to deadlines – to get a full scope of W-2 and 1099 state filing changes, head out to www.nelcosolutions.com/statechanges and find the states you need to file to.

Recently we did a webinar regarding these changes and demonstrating how Nelco can help save you hours this January – if you missed it, you can view it here: https://www.shelbysystems.com/resources/webinars/