On December 28th the U.S. Department of the Treasury and the IRS announced a limited extension to the 2015 deadlines for Affordable Care Act 1095 reporting.

It is a one-time extension and reporting is still required for Applicable Large Employers (ALE’s) and self-insured employers. The IRS made this decision based on opinions of stakeholders who felt more time was needed for organizations to prepare for ACA reporting, and for software companies to complete their ACA reporting solution.

The good news: You can still complete your ACA reporting now.

Shelby and Nelco have been working together and are ready to serve your ACA reporting needs immediately. The IRS, Shelby and Nelco all encourage filing as soon as you are ready! ACA electronic reporting solutions in both ShelbyNext Financials and v.5 are ready to accept your 1095 filings now, along with your W-2 or 1099 filings.

This season you can try out paperless ACA filing at a discounted rate. Use promo code BA4 at check out to receive 10% off your filing.* Just click the E-file button when you are ready to print your forms, log in, and you will be walked through the process. It’s quick and easy.

For a brief video demo, click here.

What does the extension mean for you?

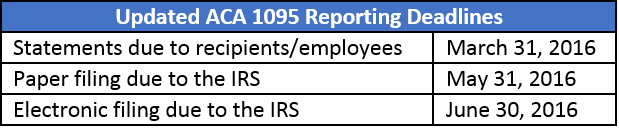

With the extension, you now have two additional months to prepare your healthcare coverage information and complete reporting. Below are the updated filing requirements.

This delay is only effective for the 2015 filing year, next year’s ACA reporting due dates will still be in line with usual W-2 & 1099 reporting deadlines. Following the standard deadlines this filing season means you will be better rehearsed for completing ACA reporting on time in 2017, it also means that you can start preparing now for reporting on healthcare information for tax year 2016.

This delay in ACA reporting deadlines has raised a frequently asked important question:

Q: Can my employees file their 2015 tax return without a copy of their 1095?

A: Yes. If you do choose to delay your ACA reporting in accordance with the extended deadlines, your employees will still be able to complete their 1040 prior to receiving their copy of form 1095. The employee simply needs to check a box on the form to indicate that they had full-year health care coverage in 2015. ACA forms do not need to be attached to a 1040, and should not be.

*One time use only.