Being responsible financial stewards is a vital part of a ministry’s call to serve God’s people well. When finances are collected and distributed with ministry at the forefront, it’s amazing to see what the Church can accomplish for the kingdom of God.

Church staff desire to be fiscally responsible and honoring with the church budget and resources. Having an accounting system that’s specifically designed for the church’s unique needs can make all the difference. That’s because nonprofits and faith-based organizations operate differently than traditional businesses, and they need a software program that meets their requirements.

Funds need to be designated and managed. Payroll for staff needs to be monitored. And tithes and offerings need to be tracked. Though some of the accounting requirements of churches could be regulated with generic business software such as QuickBooks, they will quickly see the benefits of having a system designed for religious associations. For example, ShelbyNext Financials is a state-of-the-art, cloud-based software program specifically designed for churches, ministries, and nonprofits.

In this post we will talk about what church accounting software is and the differences between churches and for-profit businesses. You’ll also gain an understanding as to why you should use a church accounting system and the features and benefits behind it.

What is church accounting software?

Fiscal responsibility, especially for churches, is essential, and having accounting software that can handle the complex finances of churches and nonprofits is necessary to maximize ministry opportunities and remain compliant for tax purposes. That’s why church accounting software is specifically designed for the unique intricacies of ministry finances.

Though similar to traditional accounting software, it's actually built to handle everything related to church finances. It includes features like tracking contributions, balancing the books, creating reports, organizing funds, and paying vendors and staff.

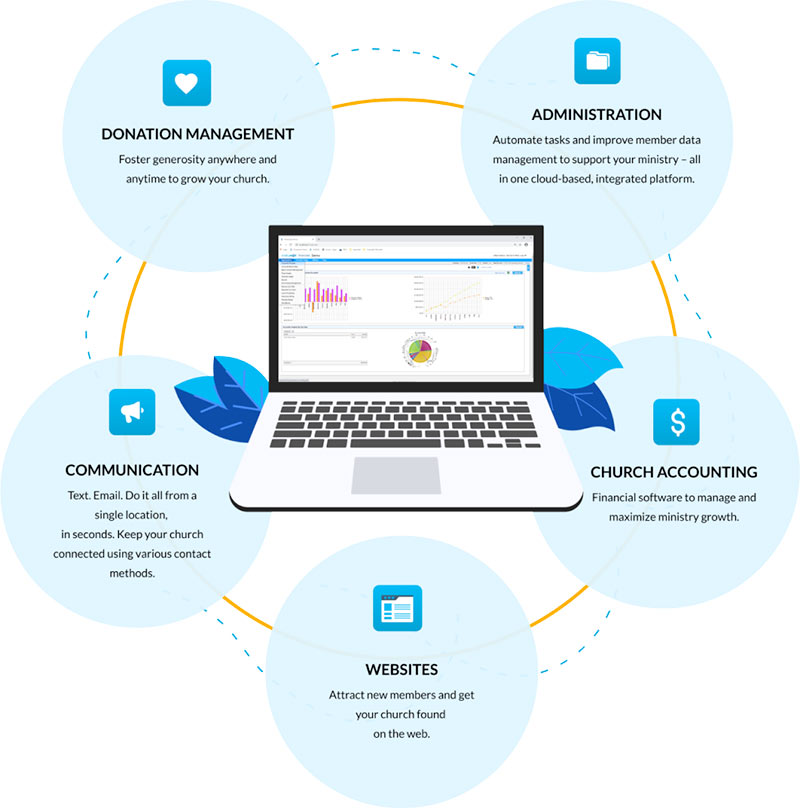

A good software program should be easy enough for anybody on your church staff to use, even if they don’t have a background in finances. As one of the best church accounting software programs available, ShelbyNext Financials helps to streamline the complicated processes of typical accounting systems, and it integrates with your other church software.

Differences between church accounting and accounting for businesses.

Businesses have very different financial goals in comparison to churches. Profitability is a business’ bottom line. On the other hand, a non-profit’s main goal is to accomplish their organization's mission. Of course, both need revenue to reach their goals, but faith-based entities use it to serve others.

To better understand the importance of church-based accounting software, we need to first understand the contrast between for-profit businesses and not-for-profit institutions.

For-profit vs. not-for-profit

As one might expect, a for-profit business is "established, maintained, or conducted for the purpose of making a profit." Business stakeholders are most concerned with the bottom line. At the same time, founders and board members of churches and nonprofits are focused on tracking contributions and allocating funds and resources based on the mission. They don't operate with the purpose of making a profit, thus the title: nonprofit. Churches and religious organizations fall under this category.

Key differences

1. Ownership

One distinction between traditional companies and churches is that various individuals and entities can be owners or shareholders of a for-profit business. These owners benefit from their company's earnings because they receive a portion of the revenue or an increase in value.

Churches, on the other hand, are not owned. No individual possesses a percentage of the organization. Under the Financial Accounting Standards Board (FASB), specific accounting principles are in place for non-profits. And each church is under the financial laws of the state in which it resides—being run by pastors, its board, and staff. Because there are no owners, the church's accounting system doesn't include owner's equity or retained earnings accounts.

2. Fund Accounting

Fund accounting is another significant difference. While businesses and nonprofits have a general ledger, nonprofits have an accounting method that manages various types of funds. For churches, this is the emphasis on accountability of where money is going versus profitability. It groups assets and liabilities according to purpose, which makes donations, or revenue, restricted in their use and can only be distributed for their specific purpose. For example, if a church is hosting a giving campaign to raise funds for an upcoming mission trip, any of the money received specifically for that campaign can only be used for that purpose. The church cannot use that money to pay for repairs on the building or host a marriage retreat without getting permission beforehand.

3. Revenue Received

Though businesses and churches can both earn revenue by selling goods or providing services, the main difference is that most of what churches receive comes from contributions, like tithes and monetary donations. Because of this, they must keep track of how much money is received and which fund it is being used for. They also have to be able to provide statements to their contributors along with other tax-related regulations.

4. Accounting Terminology

Though it may not seem like a big deal, the differences in terminology can play a big role. For example, instead of retained earnings, nonprofits categorize them as net assets. Net income is the excess of revenues over expenditures. These uses of varying terms can make it difficult for churches to adopt a secular bookkeeping service to their specific needs. Though that isn't impossible to do, having accounting software designed for churches will help organize everything finance related.

Resources:

Why you should use accounting software designed for churches:

It is created for churches.

Though it may seem like a small detail, having software designed with the church in mind can be extremely helpful. Because churches have incredibly unique needs regarding how they handle their fund management, receivables, payables, and ledgers, they need something that will work for them, not complicate things. Popular accounting programs like QuickBooks can quickly become troublesome because they do not specialize in serving religious organizations.

Resource:

It saves time and money.

Reduce administrative work, improve efficiency, and streamline your church’s financial processes. With a program created for ministry, you’ll save time because you won’t have to convert actions from a traditional business standpoint to adhere to FASB principles. You’ll also save money and headache by assuring funds are placed appropriately and used for the specified purpose.

"I would not attempt to work in the finance office without Shelby. Reports for committees and the auditors can be made as simple or complex as needed. And the software works with some great time-savers. It no longer takes all day to run payroll; TimeClock gets the job done in 5 minutes. Contributions are entered quickly and accurately with CrossCheck. And if I want to talk to a technician, it’s a free call away. Further, the Shelby programmers are topnotch in listening to my ideas. I have tried other church software in the last 15 years and nothing beats Shelby!"

– Lee Ann Houston, TX

Money can be managed from anywhere.

With a cloud-based accounting program, you can gain secure access to your church finances at any time, from anywhere. Your finance team can view data and reports in real-time. And with automatic data backups, you'll have peace of mind. If someone on your team isn't in the office but needs to balance the books or check the budget, they can do so from any device.

Import data from existing systems.

One of the main reasons churches stick with an outdated, traditional system is because it seems too difficult to switch over current donors and their information. But with the right church financial software, importing data can be done with ease. The conversion team at ShelbyNext Financials can easily import names, vendor lists, and associated contact information from any existing system. All you have to do is provide a flat-file CSV or excel spreadsheet and we take the headache out of switching accounting platforms.

Features of modern church financial software:

Ledger

All companies need to be able to track financial data. A general ledger is a record-keeping system that monitors debit and credit transactions. These transactions are segregated by type. For churches and non-profits, they are generally broken down into even smaller subgroups to keep accurate records.

With ShelbyNext Financials, the general ledger is able to operate true fund accounting that meets the specific needs of churches. The ledger will simplify the budgeting process because departments and staff can view reports and track how finances are compared. The general ledger in an accounting system designed for churches will meet the financial accounting standard requirements (FASB117), too and have a comprehensive record keeping system in place.

Benefits of ShelbyNext Financials Ledger:

- Provides flexible account structure for customized chart of accounts and reports

- Department worksheets and Excel® import/export

- Automatic deposits from member contributions and pledge postings

- Delivers non-profit reporting that reflects church ministry

Payroll

Take the hassle out of payroll for your church staff. With a system that manages all aspects of your payroll, it provides gross wage computation, calculates all necessary taxes, withholds voluntary deductions, prints a payroll check for the employee, and provides necessary totals for monthly, quarterly, and annual government and management reporting, including e-File reporting.

Manage special clergy allowances, benefits, and personal time. In fact, designating clergy and lay staff is as simple as a single check mark on a person’s record.

Your payroll system should automatically be tracked in your general ledger, so you don't have to duplicate data entry or do special imports. It is also beneficial to have payroll automatically allocated to funds and departments.

Benefits of ShelbyNext Financials Payroll:

- Guides the user step-by step through the payroll process

- Handles special clergy allocations and benefits

- Saves costly checks by printing direct deposit receipts on standard copy paper

- Satisfies all your data needs with its versatile reporting system

Resource:

“We have about 55 employees and do payroll every other week. Piece of cake, including the tax forms, & Shelby’s Support is amazingly up-to-date on this stuff! The ministers “quirks” are handled very easily & the data input is about as simple as it gets. We are blessed not to have the nasty stuff- garnishments, out-of-state people, etc., but Shelby has a place for those things, too. It’s all in how it’s set up. Once the setup is done, the thing just about runs itself! I don’t think I could ever be convinced to outsource.”

– Lori Manning, Zoar Baptist Church

Receivables

Accounts receivable represent any money that is owed for goods or services that have already been purchased. This money is usually collected later.

Accounts receivable accurately tracks payments you receive for varied sources such as church daycare and school tuitions. It also tracks billing activity for church headquarters collection of insurance, pension, and apportionments. You can get an accurate picture of your true financial position if receivables are connected to your chart of accounts

Benefits of ShelbyNext Financials Accounts Receivable:

- Boosts productivity

- Streamlines management

- Uses your central chart of accounts

Payables

On the other end, accounts payable is any money owed by a company (or in this case, a church) to its creditors. Whether a business, church, or nonprofit, it is the obligation to pay off short-term debt to vendors or suppliers.

The accounts payable application provides the ability to pay bills, manage credits from and payments to vendors, and attach invoices and other documentation. Users operate on a cash, accrual, or modified accrual basis. Module interfaces with Bank Reconciliation, Purchase Order, and General Ledger.

Using a true fund accounting system will help your church gain instant access to the financial information you need. First, track how much and where your money needs to go. Then, sync it to the general ledger to have a solid understanding of the financial status of your church.

Benefits of ShelbyNext Financials Accounts Payable:

- Secure access anytime, anywhere via the web

- User permissions by function (and fund)

- Automated data backups and software and tax table updates

Reporting

Having access to financial reports is extremely important for churches because they have a wide range of donors, pastors, and financial councils that need to view such reports.

The system provides general ledger monthly standard reports along with an easy-to-use, custom presentations report builder. The major general ledger reports also provide drill-down functionality back to a single application entry. Plus, all reports are downloadable in several formats.

Connecting church staff to their accounting records is crucial to maintaining accountability and up-to-date financial status.

Benefits of ShelbyNext Financials Reporting:

- Take the stress out of providing financial statements to those who need them

- Get instant access to your church financial reports securely on the web

- Satisfy all your data needs with a versatile reporting system

Resource:

Integrations

Having a church accounting system that is integrated with your church management software (ChMS) and your online giving is critical. It will help streamline complicated processes and save valuable time. Be an excellent steward of your two most valuable resources: people and finances.

Reduce the number of errors caused by manual data input. Reconcile contributions and receipts with online giving and accounting. Track your members and donations a comprehensive, easy-to-use system.

Benefits of Integrated ShelbyNext Financials:

- Built to provide transparent financial visibility

- Streamline your existing accounting processes

- Have one system in place for multiple functions